ELAINE analyzed Pepsi's Earnings Reports and the earnings conference transcript of the Q&A session with analysts.

ELAINE's narrative abstraction (company, growth, revenue, eps) in the analysis of the earnings report shows headwind on foreign exchange:

"...the Company now expects an approximate 2.5-percentage-point foreign exchange translation headwind (previously 2 percentage points) to impact reported net revenue and core EPS growth based on current market consensus rates.. . This assumption and the guidance above imply 2022 core EPS of approximately $6.73 (previously)"

On the analysis of the Q&A narrative with analysts, "growth", "consumers", and "brands" were the top topics of discussion.

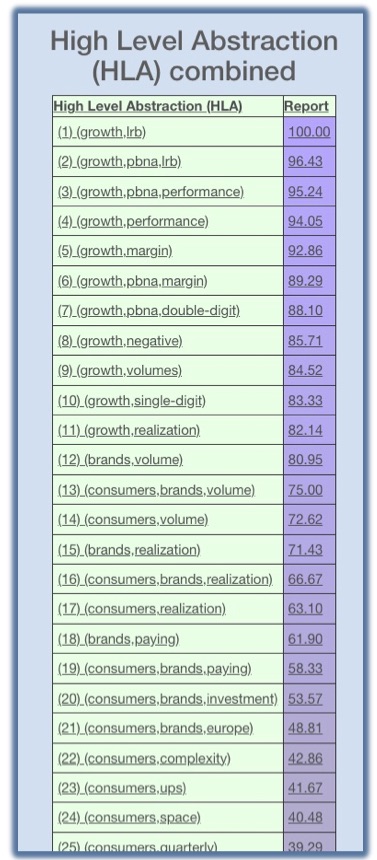

ELAINE's High Level Abstraction from Q&A Narrative

On (growth, performance):

"But overall, we measure our performance is total LRB and total LRB share in the quarter was flat to the category as you saw double-digit growth, which is a pretty good performance for PBNA."

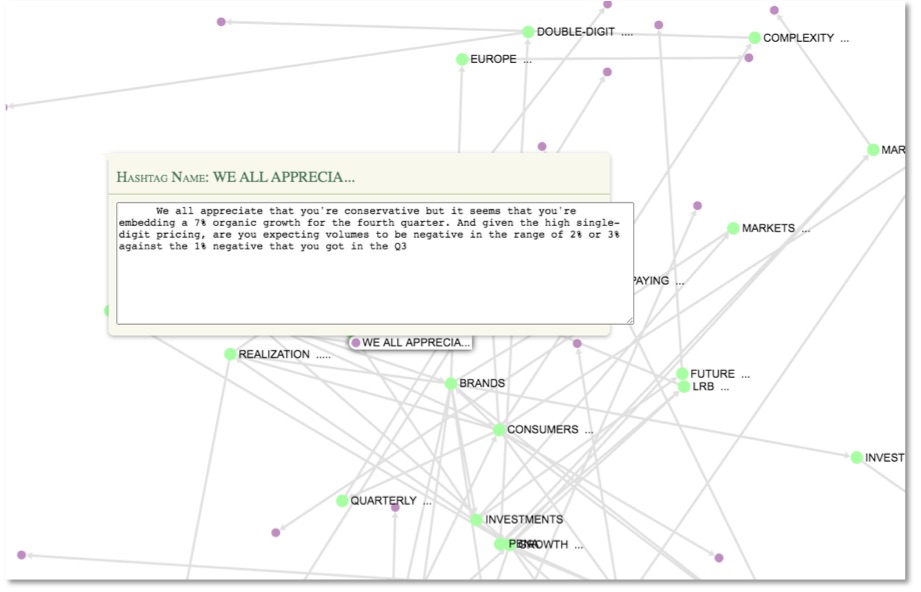

On (growth, volume):

"We all appreciate that you're conservative but it seems that you're embedding a 7% organic growth for the fourth quarter. And given the high single-digit pricing, are you expecting volumes to be negative in the range of 2% or 3% against the 1% negative that you got in the Q3?"

On (growth, realization):

"Your top line growth in the quarter, as we've all been discussing, was very impressive, but it was fully driven by strong price realization. So I guess my question is on your market share. Could you give us a sense of how your share has been trending in both maybe your beverage and Frito-Lay businesses? And then I know a priority of yours is to improve your op margins in PBNA, especially. So maybe give us a sense of how you're going to balance market share growth with profitability growth going forward?"

Knowledge map

Conclusion:

Besides FX headwind and tight margin as a result of double digit growth on flat LRB, part of PEP's growth strategy relies on the success of Celsius.

"... we're in a building position here, whether it's Rockstar or Mountain Dew Energy or what we're doing with Celsius or for that matter, even the Starbucks Coffee Energy business. But we now think we have three or four different ways to compete, to capture that consumer's business. So we like where we sit in that growth."