ELAINE's Narrative Analysis of Major Banks' Earnings Transcripts

by Sing Koo, Oct 24, 2022

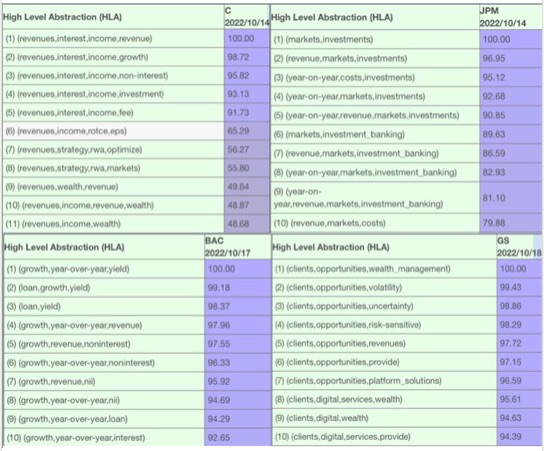

Gauging the state of our economy, I turned to the narrative analysis of Earnings from four banks. Here are some highlights from ELAINE's Narrative Analysis - there are reasons for concern down the road, but the overall feeling is that they are on day one CECL levels as they are paying attention to risk-weighted asset (RWA) and reserve. To get some real sense of it, I took the following from ELAINE's relevancy assessment. The following are the most relevant excerpts according to ELAINE:

JPM (JPMorgan Chase)

"Expenses of $19.2 billion were up $2.1 billion or 12% year-on-year, driven by higher structural costs and investments. And credit costs of $1.5 billion included net charge-offs of $727 million. The net reserve build of $808 million included a $937 million build in Wholesale, reflecting loan growth and updates to the Firm's macroeconomic scenarios, partially offset by $150 million release in Home Lending."

BAC (Bank of America)

"... lower securities balances over the past six months modestly offset the benefits of year-over-year loan growth."

GS (Goldman Sachs)

"And candidly, this is one of the reasons why we're integrating Asset and Wealth Management is as we believe by putting these platforms together, we have the best eye and the best breadth to really understand where the opportunities are to serve our clients and also where the opportunities are for good performance"

C (Citibank)

"we show the results for our Personal Banking and Wealth Management business. Revenues were up 6% as net interest income grow was partially offset by a decline in non-interest revenue, driven by lower investment fee revenue in Wealth and higher partner payments in Retail Services."

Contact us to view the interactive narrative analysis of the above earnings transcripts.