To demonstrate this issue, we conducted a session with Generative AI

The content of an article published by CNBC, "IMF upgrades global growth forecast, citing U.S. resilience and policy support in China" was submitted as part of the prompt to GPT, a Generative AI system from OpenAI. The following is a copy of the GPT session

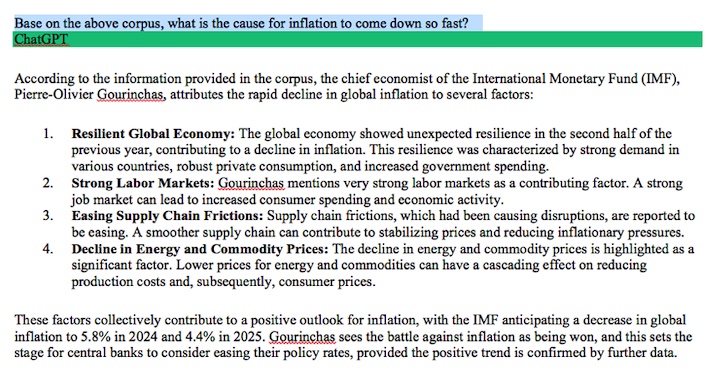

The question to GPT is "Based on the above corpus, what is the cause for inflation to come down so fast?"

What was GPT's response?

GPT pointed to four items in its response. Out of the four factors, two of them, namely, "Resilient Global Economy" and "Strong Labor Markets" are actually signs for inflation to go up, not down. However, due to the style and verbage rendered by GPT, it sounds convincing and authoritative. A user without adequate knowledge of general economic trends on inflation would be misled by the response.

In fact, all these four points given by GPT as reasons for inflation to come down so fast is taken out of context.

Fact Check GPT response

Contrary to GPT's response, economic growth is generally the reason inflation goes up. A strong job market is also a reason for inflation to increase.

"resilient global economy" is normally a precursor of higher inflation. IMF expressed worry that Central Banks would be reluctant to lower interest rate, which would slow down the decline of inflation as evidenced in the following excerpt:

"What we've seen is a very resilient global economy in the second half of last year, and that's going to carry over into 2024," IMF's chief economist, Pierre-Olivier Gourinchas, told CNBC's Karen Two on Tuesday.

"This is a combination of strong demand in some of these countries, private consumption, government spending. But also, and this is quite important in the current context, a supply component as well. ... So very strong labor markets, supply chain frictions that have been easing, and the decline in energy and commodity prices."

"While central banks must not ease too early, there is also a risk coming into sight of policy remaining too tight for too long which would slow growth and bring inflation below 2% in advanced economies, Gourinchas added."

An explanation by a U.S. Bank also stated strong labor market is a reason for inflation to stay high:

"One consideration that could affect any decisions by the Fed is job market's ongoing strength, which may continue to provide consumers the wherewithal to maintain higher spending levels. That heightens the risk that inflation could persist or even trend higher."