What can we tell about our economic future from JPM's Q3 2022 earnings?

Using ELAINE's analysis on causality, JPM is facing challenges on margin, loan and reserve.

Asset & Wealth Management fee linked to this year's market declines

Growth in loans from card is indicative of consumer buy on credit

Reduction of home loan shows receding mortgage loans

All these factors impacts reserve negatively. With the coming rate hike, these factors will likely deepen, offering additional evidence on temporal recession.

ELAINE's findings:

"Expenses of $19.2 billion were up $2.1 billion or 12% year-on-year, driven by higher structural costs and investments."

ELAINE's abstraction of latest challenges:

(revenue,income,margin)

(year-on-year,income,margin)

(year-on-year,revenue,income,margin)

(year-on-year,revenue,margin)

(year-on-year,costs,credit)

(year-on-year,credit)

(year-on-year,costs,reserve)

(year-on-year,costs,release)

(year-on-year,costs,performance)

(year-on-year,costs,loan)

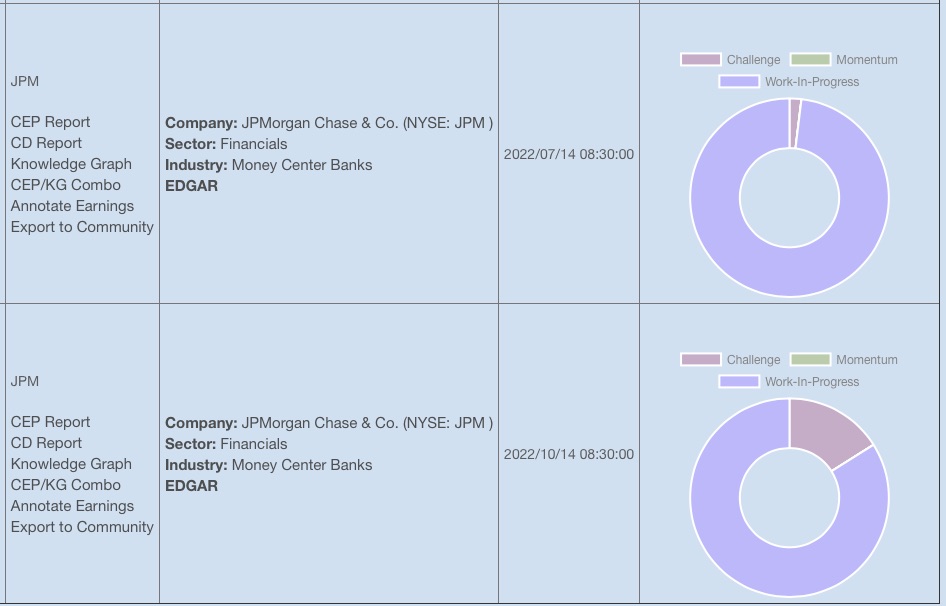

Comparison on the last two consecutive quarters, ELAINE sees a definitive increase in challenges.

ELAINE multi-quarter analysis of JPM Earnings