How to use Abstraction to Calibrate Business Operations?

Getting to know competitors' tailwinds and headwinds offer great benefits to strategists and sales. If a tailwind works for one company, the same tailwind can be applied to similar businesses, or perhaps some additional adaptation is required. The trick here is time to market. The window of opportunity is short.

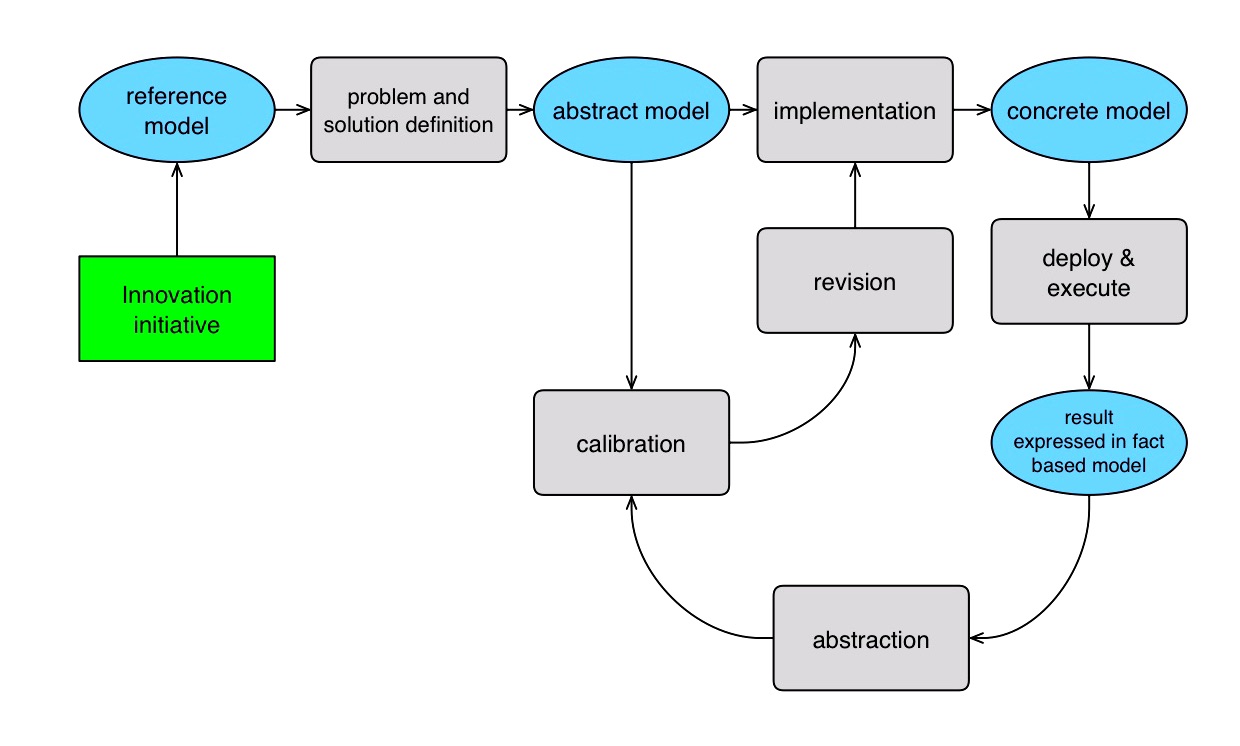

Leveraging earnings intelligence to grow or monetize requires timely deep-dive into voluminous transcripts. By implementing an abstraction framework, it makes the job of founders/chief executives much easier. Private equities and venture capitals can also leverage on such technology to manage their portfolio companies.

With full knowledge of a business model, result of current execution, outlook, and assessment of impact from external factors enable management team to revise business operations. But it is not a simple task since many business processes are related, integrated, and dependent on cash flow and macro economic.

One way to approach this complicated task is to abstract current operation against two key aspects:

1. Understand the relevancy on major components

2. Understand the head-wind, tail-wind, and critical business components

If most relevant component is aligned with tailwind, outlook is rosy.

If most relevant component is aligned with headwind, revision is needed to address the headwind in order to have a better outlook.

If most relevant component is aligned with work-in-progress, confirmation will help to insure that operation is on track.

An earnings conference call transcript is a formal narrative. As a narrative, it describes the nexus of results from business operations. The part that is needed is abstraction. Being able to abstract the two key aspects will offer fresh ideas for the management team to deliver better result. By applying symbolic logic, predicate calculus and contextual calculus to the earnings call transcript enable executives to understand meta information that is hidden in the transcript.

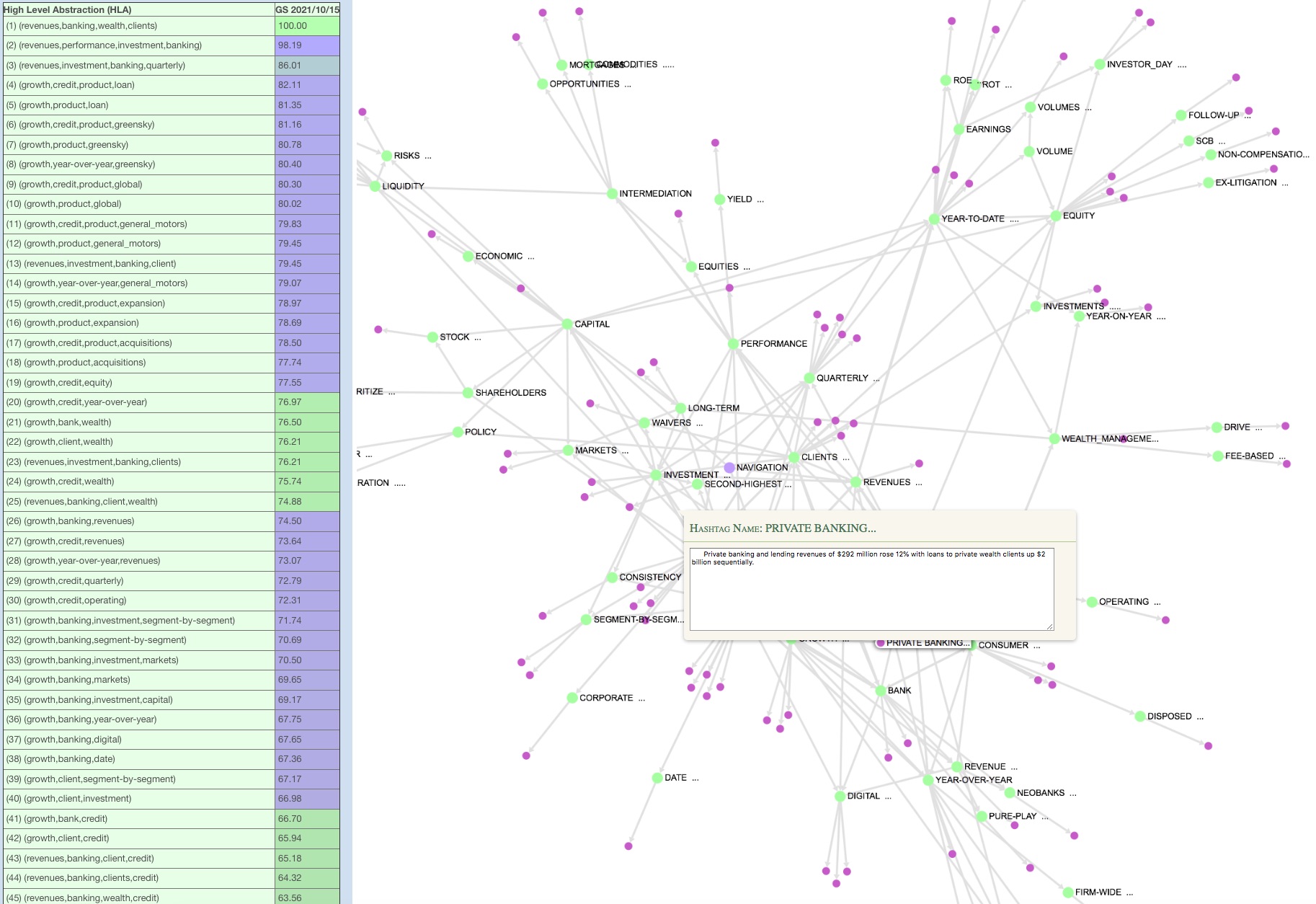

For example, abstraction of Goldman Sachs Group Inc.'s recent earnings transcript shows:

Tailwind: "Private banking and lending revenues of $292 million rose 12% with loans to private wealth clients up $2 billion sequentially. ..."

Headwind: "The decline in FICC intermediation versus a year ago was the result of lower revenues in rates, credit, and mortgages offset by materially better performance in commodities and higher results in currencies ..."

It also reflects that its operation is in alignment with tailwind, offering a nice outlook for the subsequent quarter.

Contact us to see ELAINE's interactive analysis of Goldman Sachs Earnings Transcript

ELAINE transforms any document into structured knowledge - enables managers and executives to think with clarity faster, smarter and make better decisions by leveraging logical thinking of others, especially experts in the domain of discourse.

ELAINE is built with pure JAVA, and does not require GPU or special hardware.

To learn how ELAINE can help in getting the relevant information from your internal Wiki or Earnings Intelligence, contact us

If you are interested to experience with ELAINE, Click here to learn more