ELAINE Analysis of

Microsoft Q1 2023 Earnings Conference Transcript

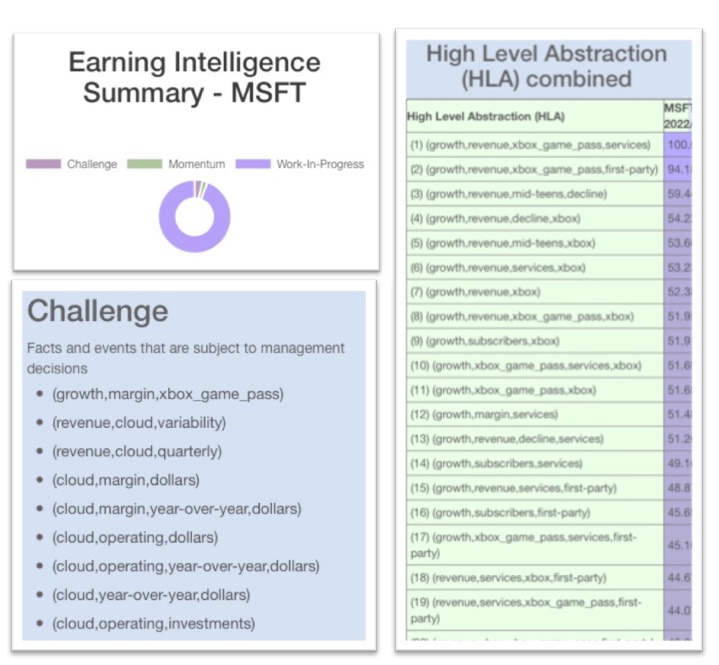

ELAINE analysis shows the top concerns are: Growth, revenue, and cloud.

Key Focus:

"That included several first-party title launches, partially offset by growth in Xbox Game Pass subscribers ..."

"Xbox content and services revenue declined 3% and increased 1% in constant currency, driven by declines in first-party content as well as in third-party content where we had lower engagement hours and higher... "

"... monetization, partially offset by growth in Xbox Game Pass subscriptions"

The Donut Chart shows the proportion of Work-in-Progress outweighs tailwind and challenge.

Challenge in revenue growth and margin in Xbox and cloud:

(growth,margin,xbox_game_pass)

"Xbox content and services revenue declined 3% and increased 1% in constant currency, driven by declines in first-party content as well as in third-party content where we had lower engagement hours and higher monetization, partially offset by growth in Xbox Game Pass subscriptions.. . Segment gross margin dollars declined 9% and 4% in constant currency, and gross margin percentage decreased roughly five points year-over-year driven by sales mix shift to lower margin businesses"

(cloud, margin, year-over-year, dollars)

"Company gross margin dollars increased 9% and 16% in constant currency, and gross margin percentage decreased slightly year-over-year to 69%, excluding the impact of the latest change in accounting estimate, gross margin percentage decreased roughly 3 points, driven by sales mix shift to cloud, the lower Azure margin noted earlier and Nuance"

Outlook on (Growth, Revenue, Operating, Income) :

"At the total company level, we continue to expect double-digit revenue and operating income growth on a constant currency basis. Revenue will be driven by around 20% constant currency growth in our commercial business, driven by strong demand..."

The takeaway:

Growth in Xbox Game Pass subscriptions but lower engagement could be indicative of a growth that may not be sustainable.

Tailwinds and headwinds rank low relevancy in the ELAINE HLA table. This can be an indication of the lack of confidence on growth in these areas.

"constant currency" is mentioned in relation to revenue. Cloud is identified as a weakness in relation to the strong dollar. Could this mean international market is impacted by the strong dollar?