You don't have to be an economist to read market signals when you have ELAINE by your side.

JP Morgan Chase is one of the largest money center banks in the U.S.

ELAINE analysis of JPM's latest earnings transcript shows there is a crack in the economy.

Here is the key finding brought out by ELAINE:

"So, in other words, we're sort of saying that as we -- as the environment continues to normalize in a variety of ways, so that includes policy rate normalization, rate curve formalization as well as run rate normalization and Markets revenues with the sort of some background expectation of growth in our Markets and Investment Banking revenues with the background expectation of growth, and when all of that plays out and is finished playing out, we believe we should be back to 17%, all else equal ..."

Then it continues:

"We're not cutting back in growth plans or bankers or markets or countries because there was some wage inflation"

Insights derived from ELAINE's finding:

- Economy is moving to a new normal driven by policy rate, rate curve, run rate and markets revenues.

- Accordingly, it will affect IB revenue

- Outcome is dependent whether this new normal will sustain current growth

- Assuming that inflation is just on wages.

Given that inflation is not just wages, economic growth is questionable in the coming quarters.

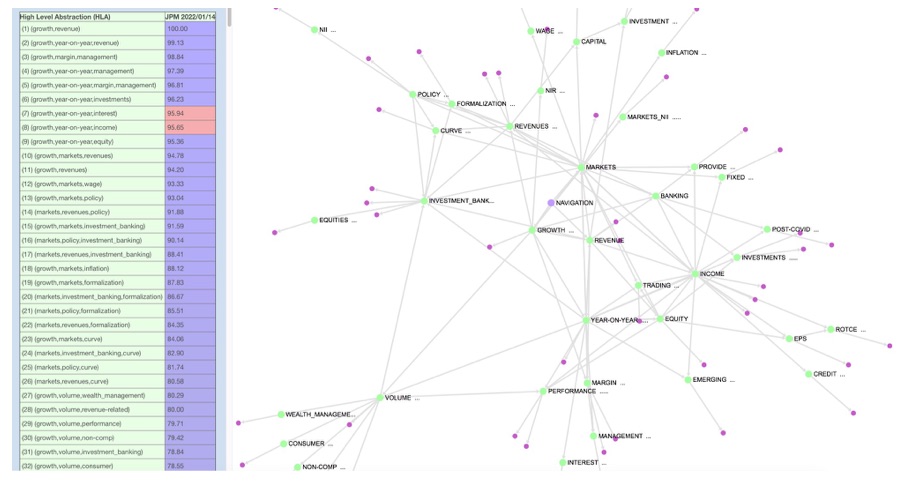

ELAINE's relevancy table entries 7&8 depicted the following challenges for JPM, indicating that growth and income will likely be impacted by interest rate.

- (growth, year-on-year, interest)

- (growth, year-on-year, income)

Contact us to see ELAINE's interactive analysis of the use case discussed here.

If you are interested to experience with ELAINE,

Click here to learn more