Oct 10, 2022 - Constellation Brands held its Fiscal Year 2023 Q2 Earnings conference call on Oct 6 2022. Reaction from Analysts is mixed and its stock has been trending downward following earnings release.

source: CNBC.com

ELAINE analyzed Constellation Brands Earnings Conference Transcript - Executive Statement and the Question-and-Answer Session.

The followings are results of ELAINE's analysis:

Executive Statement analysis donut ring shows Momentum, Challenge, and Work-in-Progress

Analyst Question-and-Answer analysis shows only Work-in-Progress, no Momentum, and no Challenge

1. Executive Statement

ELAINE's key takeaway :

"Given the strong performance of our beer business, we are now targeting full year fiscal 2023 net sales growth of 8% to 10%, and operating income growth of 3% to 5% for that business."

"This gives us confidence to increase guidance for our beer business, as we now expect to achieve 8% to 10% net sales growth and 3% to 5% operating income growth for fiscal 2023, which Garth will review in more detail shortly"

"Our strong Q2 results were led by 12% increase in net sales driven by growth in both our beer and Wine & Spirits businesses. Additionally, we achieved a 10% uplift in operating income underpinned by significant double-digit increase in the operating income of our beer business"

"We are making good progress against our operating plan and strategic initiatives, and we are now expected to exceed our previously stated fiscal 2023 net sales goals for the beer and Wine & Spirits businesses and our operating income goal for the beer business."

Abstraction from narrative:

Growth and operating strategy of beer and spirit are the main focus of executive strategy.

2. Question-and-Answer Session with Analysts

Key takeaway:

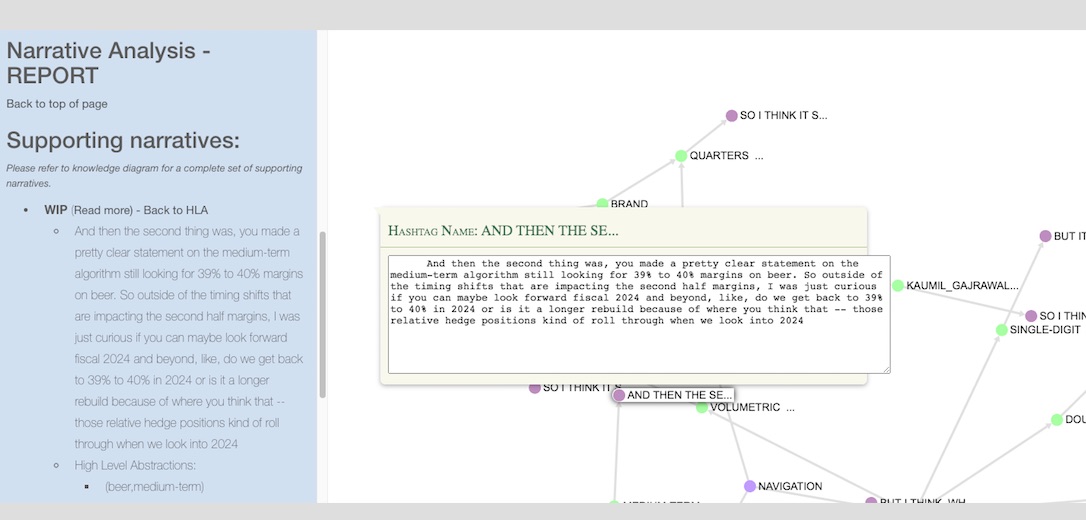

"And then the second thing was, you made a pretty clear statement on the medium-term algorithm still looking for 39% to 40% margins on beer. So outside of the timing shifts that are impacting the second half margins, I was just curious if you can maybe look forward fiscal 2024 and beyond, like, do we get back to 39% to 40% in 2024 or is it a longer rebuild because of where you think that -- those relative hedge positions kind of roll through when we look into 2024"

"But I think, what we are seeing is, we continue to see a long runway for growth in our beer business and we think that's in the 7% to 9% range consistently. We think, we are going to see consistent delivery of 39% to 40% on the margin play."

Abstraction from narrative:

3. Assessment of findings

a. Corresponding excerpts linking to the abstractions provide further inference:

b. Executive reports favorable results for the quarter and continues with their strategy on growth and expansion:

"Over the past three years, we reshaped ourselves into a higher-end wine and spirits division with intentional, strategic mainstream plays"

"Shifting to our third priority of reinvesting to support the growth of our beer business, as noted earlier, our capacity expansions and construction processes continue according to plan."

c. ELAINE identified an abstraction (beer, operating, spirits, outshine) labeled as a challenge with the following excerpt:

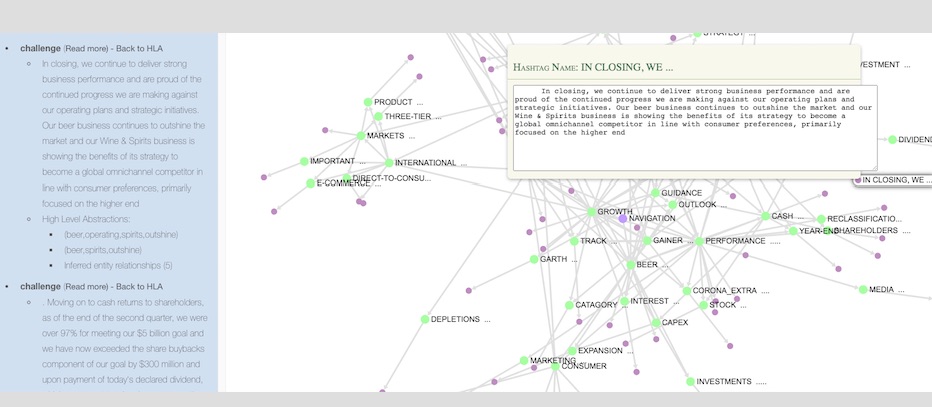

challenge (Read more) - Back to HLA

- "In closing, we continue to deliver strong business performance and are proud of the continued progress we are making against our operating plans and strategic initiatives. Our beer business continues to outshine the market and our Wine & Spirits business is showing the benefits of its strategy to become a global omnichannel competitor in line with consumer preferences, primarily focused on the higher end"

- High Level Abtractions:

(beer, operating, spirits, outshine)

d. Analyst on the other hand raised concern on work that is in progress.

"you made a pretty clear statement on the medium-term algorithm still looking for 39% to 40% margins on beer. So outside of the timing shifts that are impacting the second half margins, I was just curious if you can maybe look forward fiscal 2024 and beyond, like, do we get back to 39% to 40% in 2024 ... "

4. Conclusion:

Executive is confident that there is a long runway for growth.

Assessing current economic condition, inflation seems to also have a long runway. Undoubtedly "Capacity expansions and construction" will be more costly which will impact the bottom line.

U.S. Dollar is strong. Expanding international footprint may encounter some headwind taking into consideration exchange rate will affect price competitiveness.

Consumers may be more cautious on high-end spirit spending when there is an economic downturn.

*Information provided is solely for the purpose of demonstrating narrative analysis. It does not offer investment advices.