The Power of Abstraction in Qualitative Analysis

Natural language communication is an integral part of business processes. A good understanding of the narrative inspires creative thinking. For average readers, getting the gist through reading is not a challenge. However, it is more difficult to get the insight from such reading to spark creative thinking. The key to creative thinking is abstraction of key elements in a narrative to look for alternatives. For example, a narrative may talk about different ways of interpreting Consumer Price Index with regards to inflation but fall short in telling us how we can leverage it to derive better business outcome. If inflation shows signs of slow-down, a business manager may anticipate the cost of material to come down in near term, in turn, affecting the procurement strategy. With the advent of Artificial General Intelligence (AGI), it is now possible to delegate such understanding and abstraction of narrative to machine intelligence. ELAINE is an implementation of the AGI technology. ELAINE uses symbolic logic to discover stories and nexus in a narrative, evaluate relevancy of subjects, and present abstraction on the narrative so that user can dive right into creative thinking to look for alternative solutions.

As an illustration, we let ELAINE analyzed an opinion article published by MarketWatch "Everybody is looking at the CPI through the wrong lens" by Rex Nutting.

It is a narrative that offers a contra view on the current inflation.

Click to view ELAINE's analysis.

The article is short, about 6500 characters. One may say an average reader can read it in minutes, so what is the point of having ELAINE to analyze such a short article.

A key feature of ELAINE is "abstraction"

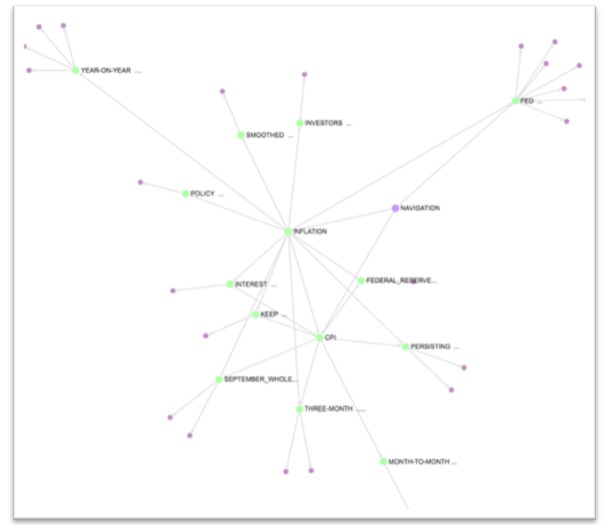

When abstraction is expressed in a knowledge graph, it shows the nexus on key subjects.

By following the navigation nodes, the key subjects are inflation, CPI, year-on-year, and Fed. The knowledge graph depicts that "inflation" and "CPI" are the ones with most nexus on different subjects.

Below is a snap shot of the knowledge graph:

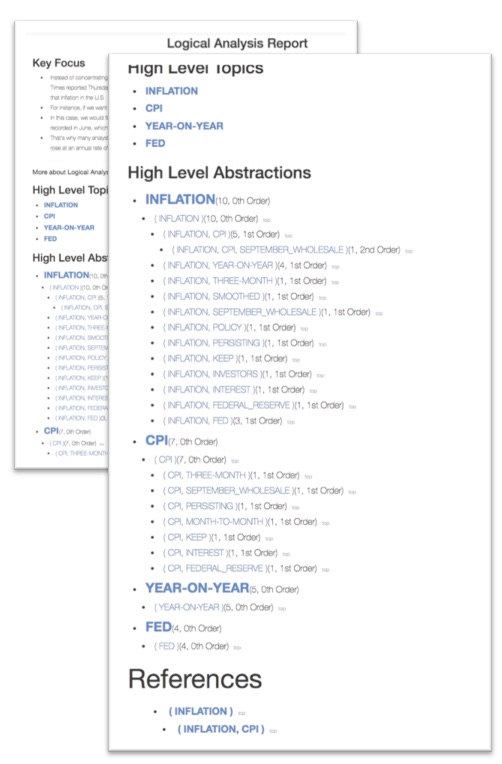

The relationships are also depicted in ELAINE's Logical Report where Inflation, CPI, Year-on-Year, and Fed are the "High Level Topics":

For each high-level topic, it shows all subjects that are sub-ordinated to the topic.

With reference to temporal," CPI" draws relationship with "MONTH-TO-MONTH" while "INFLATION" draws relationship with "YEAR-ON-YEAR" and "THREE-MONTH". It becomes apparent that CPI and INFLATION are being viewed from different perspective.

For the subject "FED", there is no nexus but four excerpts. This shows the perspective that is taken by Central Bank. The excerpts summarized FED's point of views according to the author. It clearly stated that:

"CPI set to show inflation remained near a 40-year high in September Wholesale prices rise for first time in three months and show U.S. inflation still raging Fed more worried about risks of 'unacceptably high' inflation than overdoing rate hikes, meeting minutes show ..."

For the subject "YEAR-ON-YEAR", it shows five excerpts. These excerpts pointed out the important of evaluating inflation using a year-on-year approach.

"... we may miss clues about how much inflation we have yet to endure, which is the most important question ..."

Upon validating such opinion with facts, one can take advantage of the differences in perspective between inflation slowing down and Central Bank's posture on rates. Such insight can be leveraged to inspire investment decisions as well as business initiatives.

Join ELAINE Community to put ELAINE working for you.